Maine offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Home Energy Rebates

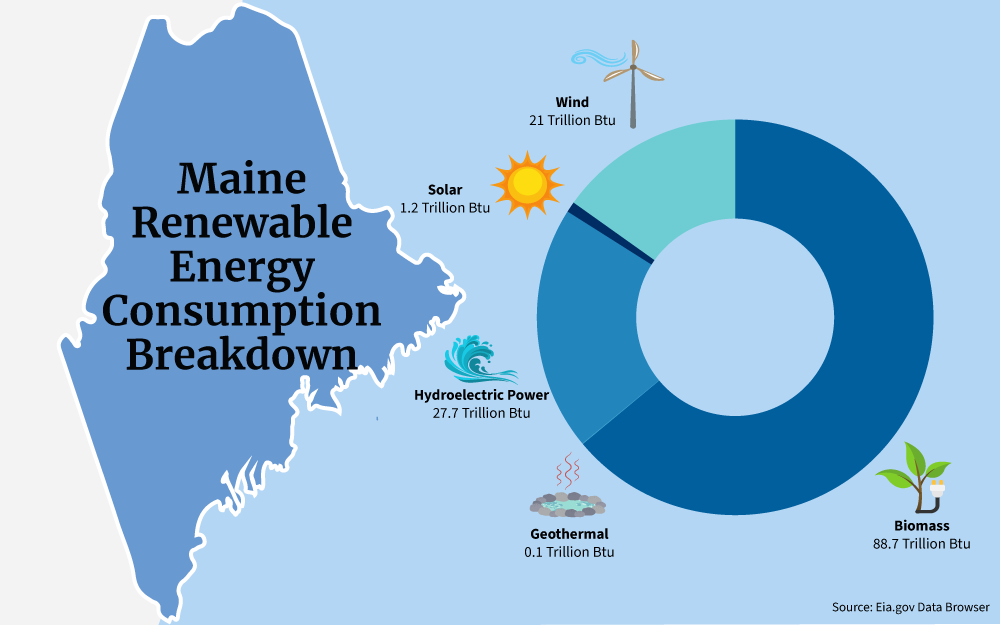

Renewable Energy

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Maine State House

2 State House Station

Augusta, ME 04333

(207) 287-1400

Hours: M-F 8:00am-5:00pm

Central Maine Power

162 Canco Rd

Portland, ME 04103

Phone: (800) 750-4000 (Residential)

Phone: (800) 565-3181 (Non-Residential)

Email: [email protected]

Live Support Hours: M-F 7:30am-6:00pm

New Service Support Hours: M-F 7:30am – 4:00pm

Energy Division

Maine Governor’s Energy Office

62 State House Station

Augusta, Maine 04333

Dan Burgess – Director

Phone: (207) 624-7449

Email: [email protected]

Monday – Friday

9:00am – 5:00pm, subject to change

Gray/Portland Weather Bureau

P.O. Box 1208 1 Weather Lane

Gray, ME 04039

(207) 688-3216

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Maine Clean Energy

Solar

Green Power

Renewable Programs

Net Energy Billing

Community-based Renewable Energy Pilot Program

Power Outage Map

Maine Department of Environmental Protection

17 State House Station

32 Blossom Lane

Augusta, Maine 04333-0017

Phone: (207) 287-7688

Fax: (207) 287-7826

Monday – Friday

8 AM – 5 PM

DEP Northern Maine Regional Office

1235 Central Drive,

Presque Isle, ME 04769

Phone: (207) 764-0477

Fax: (207) 760-3143

DEP Eastern Maine Regional Office

106 Hogan Road,

Bangor, Maine 04401

Phone: (207) 941-4570

Fax: (207) 941-4584

DEP Southern Maine Regional Office

312 Canco Road,

Portland, ME 04103

Phone: (207) 822-6300

Fax: (207) 822-6303

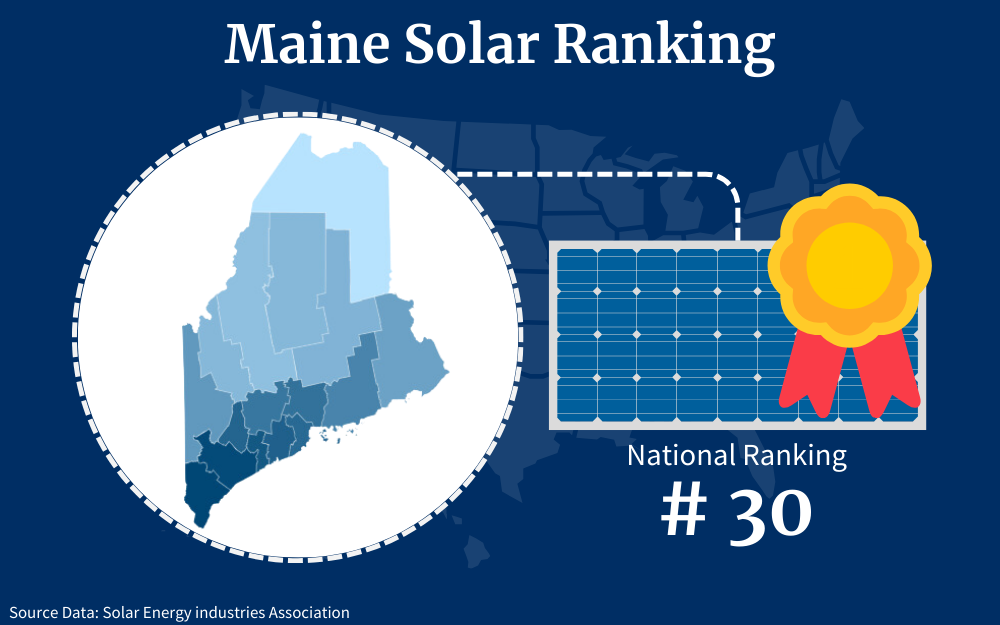

Going solar in Maine is a great way to reduce your energy expense and de-connect from the grid with green energy, or get paid for the solar power you produce at home.1

This comprehensive solar energy guide outlines the steps that show exactly what you need to get your home solar-powered, as well as the financial subsidies and other Maine solar incentives you can get for solar power, and how much savings you’ll earn from it in the long run.

What Type of Credits Does Maine Offer for Solar Power?

Tax credits are financial incentives that the government offers in order to encourage citizens to utilize certain programs and activities that are considered favorable to the environment, the economy, or society at large.

Through tax credits, a person’s tax liability is minimized on a dollar-for-dollar basis, meaning whatever credit you incur will directly be deducted from the total tax you owe.

One such tax credit, that is offered by both the federal and state government, is for the use of clean energy. The Office of Energy Efficiency & Renewable Energy (EERE) is the main government arm that is responsible for programs like this that encourage the adoption of renewable sources of energy across the country.

Some states have their own local versions of the clean energy tax credit with different deductible amounts while others do not, but there is one that all American citizens can take advantage of: the Residential Clean Energy Credit, under which the Federal Solar Tax Credit falls.4

In Maine, you can earn this tax credit if you invest in a solar photovoltaic (PV) system to power your home. You only need to keep all necessary documentation from the time of installation like receipts and invoices to file Form 5695, also known as the Residential Energy Credits form provided by the IRS, and file it alongside your tax return for the year it was installed.

EERE Programs Explained: Residential Solar Tax Credits

There is no doubt that the switch to renewable energy is beneficial to both the environment (less reliance on fossil fuels) and the economy (creation of more jobs). But as you may already be aware, investing in the technology for this isn’t cheap, especially for average homeowners.

Under the Office of Energy Efficiency and Renewable Energy (EERE), different programs have been launched to motivate solar energy manufacturers and providers, as well as businesses and residents to invest in clean energy for their properties.

The following is a list of federal and state programs that are principally created to make solar power more affordable for residential properties, specifically the programs that Maine residents can benefit from.

Federal Solar Tax Credit

The federal solar tax credit,15 previously known as the Investment Tax Credit or ITC, is the federal government’s incentive program for residents who invest in a home solar energy system.

Congress recently passed a bill extending the solar tax credit from 2022-2032 and raising the amount to 30 percent from the previous 26 percent,14 making it one of the biggest tax credits offered by the government in all states.

Many people ask, “what is the maximum solar tax credit?” Currently, it is 30 percent, but will decrease in upcoming years.

There is also no cap on the amount you can claim from that 30 percent.

If you spent $20,000 on your solar PV system for your Maine residential property, then you can get a total savings of $6,000, and that amount would be deducted from your income tax for the year you had it installed.

Bear in mind, though, that there are other parameters you need to adhere to in order to be eligible for the solar tax credit.

- The property must be residential and located in the United States.

- Your home solar energy system needs to be newly installed or used for the first time.

- You must be the owner of the PV system; either you are the homeowner yourself or a tenant who paid a share in the installation.

If you’re wondering, “how long will it take to get my rebate?” The answer is since this is in the form of a credit, it is non-refundable and won’t apply if it exceeds your income tax.

Your remaining credit will carry over instead to the next year and so on until you use it all up.

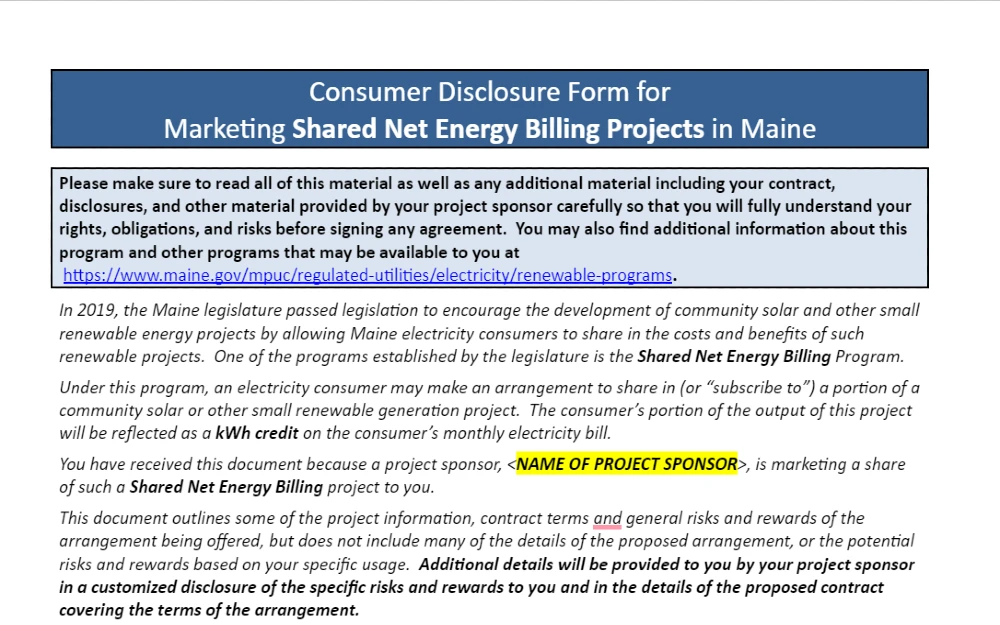

Net Energy Billing (Net Metering Process)

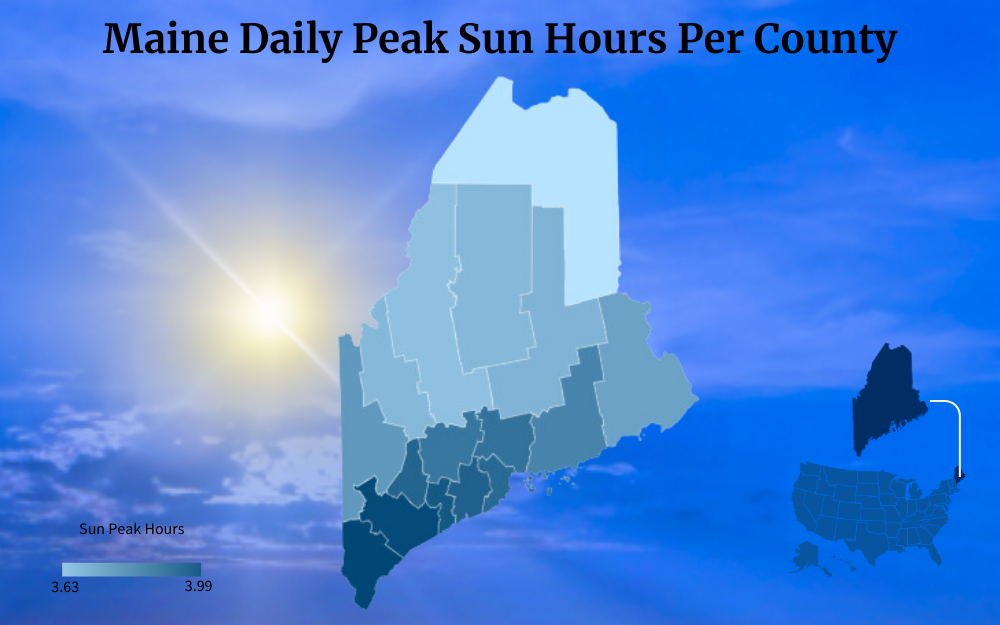

Your solar PV panels will produce different amounts of energy during different seasons. In the summer when there’s an abundance of sunshine, it of course will be able to generate more, and most of the time, the generated power would be more than enough for what your property needs.

What happens to the excess energy then?

What you can do is put it in storage so you can use it at night or in colder months when your solar panels won’t be able to produce as much electricity.

You can either have your solar PV system self-contained, wherein all that extra energy can be stored in batteries you keep in your own home. Or you can have your panels connected to the electrical grid in your area, where you can send the excess electricity for storage and have them give it back to you when you need it in the form of credits.

Net Energy Billing is one way to do this.

In Maine, Net Energy Billing (NEB) is offered not only to residential but also to commercial and industrial customers. The primary NEB program they have for residential consumers is what they call the kWh Credit Program where residents can get one-to-one credit for every kilowatt of electricity they transfer to the grid.8

For example, if your PV panels were able to generate 1,000 kWh in July and your home was only able to use 800 kWh that month, the remaining 200 kWh will automatically be sent to the grid. All the electricity you transfer every month will be stacked and banked as your credit.

When the winter months come and you rack up higher power consumption than what your panels were able to generate because of heating devices and such, you can use your credit to offset your bill for the month.

So, if your panels produce only 700 kWh of electricity in December but you use up 900 kWh, you won’t have to pay for that 200 kWh excess because it will have been deducted from your utility bill from the credit you have banked.

All in all, Net Energy Billing is a great way to make the most of your solar energy investment because you will be able to see every kilowatt you produce given back to you.

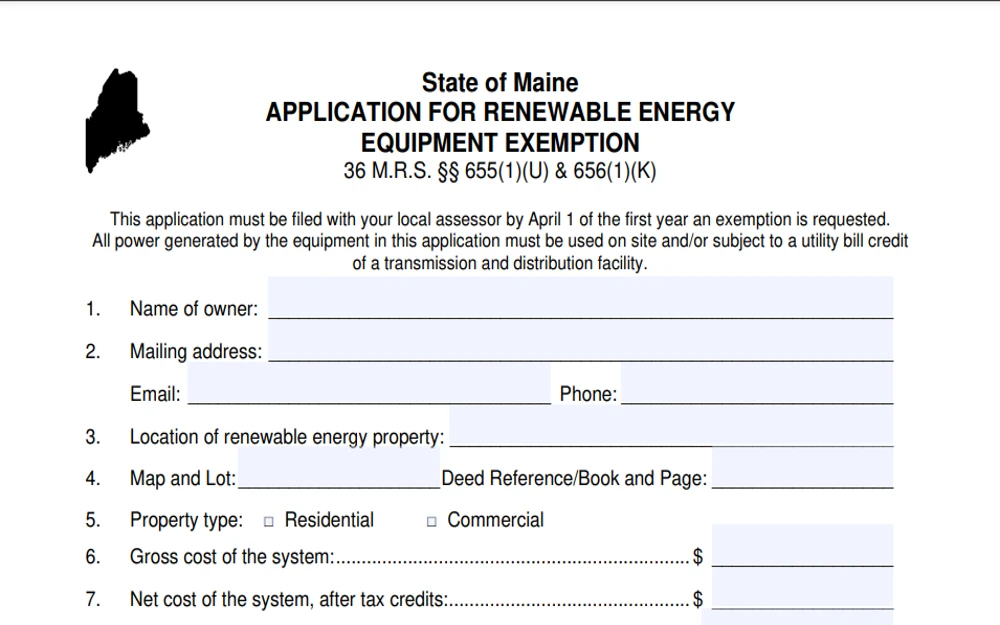

Renewable Energy Investment Exemption

Maine residents who would be installing a solar PV system on their property are qualified for certain property tax exemptions. Under this program, the State government absolves clean energy materials like solar panels from additional property tax.

To take advantage of this exemption, Maine taxpayers need only to fill out this application form.11

You can find specific instructions for every line included in the form itself, but below are some details you need to provide to give you an idea.

- The total cost of the PV system, including all the materials, installation, and delivery

- The net cost of the system minus all the tax credits and rebates

- The estimated number of years you expect to receive an energy tax credit for your system

- Details of your system, like its size, annual energy output, annual lost output, etc. These can all be provided by your installer

- If your PV system is owned by multiple people, you need to list the owners on a separate sheet and attach it to the application form.

You will have to file the application including all necessary supporting documents by April 1 of the year when the exemption is requested.

Subsidized Loans

Aside from credits and tax exemptions, there are also different low-cost loan choices to help homeowners lessen the financial burden of their home energy improvements in Maine.

One such loan is from Efficiency Maine,7 a quasi-state agency where you can borrow as much as $7,500 of unsecured loans for a low interest starting at 5.99%.

Subsidized loans like this make solar power in Maine more accessible and manageable because they generally have advantageous repayment terms for the borrower. Contact someone from the state government or ask your solar PV system provider for these options as you step into your clean energy journey.

Net Metering Explained

One way you can get your money’s worth for having a PV system installed is through net metering.

As explained earlier, since you might not be able to use all of the electricity that your solar panels in Maine will produce, all of that excess energy will be sent to your area’s electric grid if your system is enrolled in this program.

To illustrate this better, remember that a typical electric meter measures the electricity that you get from the grid. A net meter, on the other hand, would register the electricity that you will send to the grid from your solar panels.5

Your electric utility will then compensate you for every kilowatt hour you transfer to the grid. This is done through credits which you can use to offset your bill on periods when your household uses more electricity than your panels have produced.13

The kWh Credit Program offered by the state of Maine works this way.

Going Solar Without Purchasing a System

All of the credit and rebate programs for going solar are good and all, but what if purchasing one is really out of your budget? What if the high cost is the only thing that’s stopping you from utilizing clean energy?

You’re now probably wondering, “can I get solar panels free in Maine?”

There’s a simple answer to your dilemma: a Solar Power Purchase Agreement or SPPA.

The SPPA is a business model where a solar service provider or utility will offer to have PV panels that they own and operate installed in your home in exchange for a stable supply and low electricity cost.

Granted that you, the host customer, will still be buying the energy generated by the solar panels from the utility, but the advantage aside from the lower price per kilowatt hour is that this framework would eliminate all the complicated procedures and high expenditures of actually buying your own PV system.

This way, you’ll still be able to go solar, contribute to mitigating climate change, and get savings for the future.

What Forms Do I Need To Fill Out To Get the Credit?

If you’re a Maine resident who has decided to go ahead and purchase your own PV system, the exciting part now is finally claiming your solar tax credit.

After making sure you meet the criteria for the credit, you need to prepare all the documents you need for the claim. These are the following:

- Proof of Purchase: Receipts, contracts, invoices, and other documentation that would validate your expenses.

- IRS Form 5695: Also known as Residential Energy Credit form. You can get this from the IRS website.3

- Manufacturer’s Certification Statement: This is a simple certification document from your provider verifying that your home solar energy system meets the efficiency and quality standards to be eligible for the tax credit. This requirement depends on whether the IRS asks you for it, but it is best to prepare it beforehand just to be sure.

Once you have the documents ready, fill out your solar credit form or IRS Form 5695. You can find step-by-step directions on how to complete this form straight from the IRS itself on their website.2

The last step is to attach Form 5695 to your federal tax return and file it. The credit will then be applied to your overall tax liability, giving you significant savings.

What’s Involved in Solar Panel Installation in Maine?

According to data from the US Energy Information Administration, as of June 2023, the average price of residential electricity in Maine is 27.63 cents per kilowatt-hour.18 This is significantly higher than the national average of 17 cents per kilowatt-hour during the same time period.17

This makes Maine one of the states that has the highest household electricity rates in the entire country. However, offsetting this is the fact that Maine also has one of the lowest electric consumption per household across the U.S.

What You Need To Get Your Home Solar-Powered

Now, you’re probably wondering exactly how much you need to prepare to install your very own solar PV system for your home.

The answer isn’t quite simple. The cost will differ from state to state and is also dependent on the material, number, and kind of panels you need relative to the size of your property.

In order to understand this better, you first need to know what components a home solar energy system has. This way, you’ll also be able to answer questions such as, “what are solar panels for?” and the like.

Different types of systems and different providers offer varying solar equipment inclusions, but the most basic things you would require to power your home with solar energy are the following:

- Solar Panels: Otherwise referred to as photovoltaic modules, this might be what you typically picture whenever you think of solar energy. A solar module, which is mostly installed on rooftops or integrated into building materials, is made of cells that capture and convert sunlight into electricity.

- Inverter: Most homes run on Alternating Current (AC) but your solar panels will produce Direct Current (DC) electricity. Power inverters will be able to convert DC power to AC power needed for most appliances that are plugged into wall sockets.

- DC-AC Disconnect: This is basically just an electrical switch that would allow you to safely unlink the electricity generated by your panels from the inverter should there be any emergency.

- Net Meter: This measures the amount of electricity your solar units produce and will tell you how much of it you are actually using. If your system is connected to the grid, this will also tell you how much excess energy you are transferring to the grid that will be credited back to you in the future.

- Batteries (Optional): Some owners invest in batteries where they can store excess energy that they don’t use in case of a power outage.

You might be asking what is a solar array if you’ve ever encountered the term. To put it simply, a solar array is a collection of panels that are wired and linked together to generate solar energy.

You can get more information about solar panels and arrays online.

Other than the core components of a solar PV system, you also need to take into consideration the cost of some inspections and necessary permits for setting up solar panels. All of this would be added up to get the total gross cost of getting your home solar-powered.

Cost of Solar PV Installation in Maine

Solar PV systems in Maine are sold on a price-per-watt basis, and the average as of August 2023 is $2.83 per watt.12

For comparison, the national average price is $3.00 per watt, making the solar panel rates in Maine lower than in other states.16

The total installation cost, however, will vary depending on the size of the system. Since the solar panel regulations in Maine require the system’s size to be 5.7 kW, the average gross cost for that would round up to $14,150.

Don’t worry though because this would still be reduced by 30 percent after the Federal Solar Tax Credit is applied, lowering it to a net cost of $9,905.

You can refer to the table below to compare the prices relative to the system size you need:

| Solar PV System Size | Gross Cost | Net Cost (After Federal Tax Credit) |

| 5kW | $14,150 | $9,905 |

| 6kW | $16,980 | $11,886 |

| 7kW | $19,810 | $13,867 |

| 8kW | $22,640 | $15,848 |

| 9kW | $25,470 | $17,829 |

| 10kW | $28,300 | $19,810 |

Solar Energy Estimator (PV Watts Calculator)

If you’re now a little more convinced about getting a solar PV system for your home in Maine, your next step is to figure out how many solar panels you would need to cover your energy requirements.

A professional solar system installer would do this for you as part of their services, but it’s always best to get a feel of the whole thing before jumping into it.

You need three things to begin:

- Your average electricity consumption

- The wattage of your solar panels

- Your entire PV system’s production ratio

Gather your past electric bills and determine how much electricity your residential property is using monthly or yearly. For reference, the average monthly energy consumption of a household in Maine is about 550 kWh.9

What you need to do next is to find out the wattage of the solar panels you will be purchasing. In simple terms, this is the amount of power each panel will be generating under the most ideal conditions.

After this step, determine the total amount of electricity your system can produce in a year under average sunlight. This is called the solar production ratio and it will vary depending on location, but the typical ratio for solar panel in USA is between 1.3 to 1.6.

How Many Solar Panels Do You Need?

Now that you have the numbers, you can finally do the math.

The formula for this would be:

- Number of Solar Panels = kWh consumption / production ratio / panel wattage.

Say, for instance, you consume 6,600 kWh yearly for your house in Maine, and the production ratio of your solar units is 1.3 using panels with a 300 wattage, then it would look like this:

- Number of Solar Panels = 6,600 kWh / 1.3 / 300 W

The result, when rounded up, means you need 17 panels to cover the electricity usage for your home.

Alternatively, you can use a reliable solar power calculator like the one below, which is based on the National Renewable Energy Laboratory or NREL solar calculator to make this task easier.

How Much Savings Can You Get From Going Solar?

Calculating the bucks you can save from setting up solar panels is as easy as multiplying your current electricity rate (dictated by your utility) by the total production in kWh of your system.

The average electricity rate in Maine as of July 2023 is 28 cents per kilowatt hour.10 If this is your present billing rate without solar, and you install a PV system that produces 500 kWh per month, then the math would go like this:

- $0.28 x 500 kWh = $140 of monthly savings

A solar energy savings calculator will help you determine this more efficiently.

How To Find ME Solar Panels

Fully transitioning to solar energy is quite complex for the average homeowner to do on their own. What you need is a manufacturer or service provider that would help you make the whole process as smooth as possible.

To do that, you have to be critical in choosing whom to buy solar panels from.

For Maine residents, here are some things you need to practice when looking for a company to install your solar PV system:

Make a List of Providers in Your Area

It’s always better to get a local company to have your system installed as they will be more familiar with the ins and outs of state policies regarding solar power. More than that, it will also be beneficial for the local economy and the overall success of clean energy in your state.

There are comparison websites where you can get the names of solar installers Maine has to offer. Make a spreadsheet and catalog these providers as your options.

Research Their Credentials

First thing you need to tick off during this part is licensing. Make sure that the business has proper certifications, especially the electricians that would install the solar panels as this is required by law in Maine.

You can also ask the company if there is someone on their team who is certified by The North American Board of Certified Energy Practitioners (NABCEP). This isn’t a required credential for solar installers, but having employees who possess such is a reflection of them as a business that knows what they’re doing and is dedicated to giving quality customer service.

Study Your Solar Installer’s Track Record

Experience matters, so you need to choose a company with a good track record in installing solar PV systems. Read reviews and testimonials online or join social media groups and forums dedicated to solar energy in Maine and ask for people’s opinions on the company.

Additionally, you can ask the company itself to provide you with references like previous customers who can give you information from their firsthand experience.

Seek Transparency

In its consumer protection law,6 Maine requires all home improvement initiatives of over $3,000 to have a binding contract between the service provider and the client. Thus, you need to confirm that the company will give you a detailed installation proposal that outlines the services that will be provided and the specific terms of the agreement.

Look Into Support and Warranty Offers

Solar PV systems are huge investments, so it’s only right to want one that would last you decades without giving you headaches because of defects or failures. One way to ensure this is through warranties offered by your installation company.

Find an installer in Maine who can give you the best and longest warranty for their services and the solar panel material they’re using. This will prove that they’re a reliable company that stands by the quality of their work.

In addition to this, you should also check if they have ongoing maintenance support in case you need repairs and troubleshooting throughout the lifetime of your solar panels in Maine.

Going solar in Maine isn’t a particularly easy decision to make because of the high cost of a system relative to the low average energy consumption in the state.

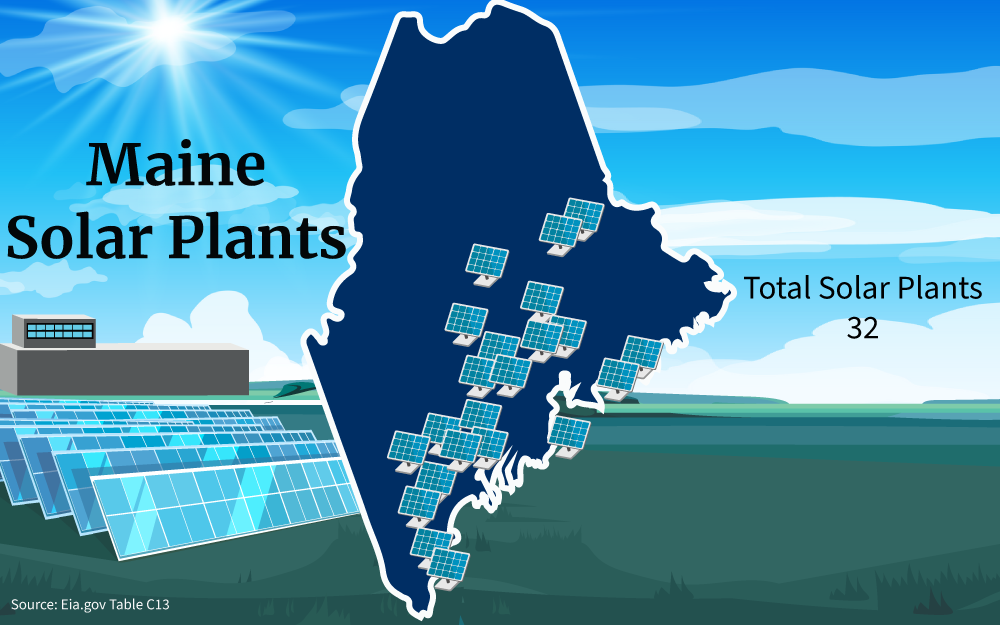

However, the local government is doing its best to make solar power more accessible to the average consumer in hopes that more residents would be able to use clean energy through their own PV systems or through solar farms.

It may be a bit daunting thinking of the budget you need to get your home solar-powered, but if you think about it as an investment of sorts, you’ll realize the money you’ll initially shell out will be returned to you in a few years anyway as it would guarantee you more savings as electricity rates continue to skyrocket.

Not to mention, availing Maine solar incentives and using clean energy like solar power is a real investment not only in the environment and economy of Maine but also in the future of this planet.

Frequently Asked Questions About Maine Solar Incentives

Can I Get Tax Credit for Roof Replacements?

Many people ask questions like, “if a roof replacement is required, is that covered by the tax credit?” It depends as materials that are only used for structural support aren’t a qualified expense but those that also serve in generating solar energy, like solar roofing tiles, for instance, are.

How Long Do Solar Panels Last?

How long solar panels last depends on the quality, environmental conditions, and maintenance of the system. On average, though, well-kept solar panels will remain functioning for 25 to 30 years.

What Is the Photovoltaic Effect?

If you’re wondering, “what is the solar process that results in the production of energy?” The answer is the photovoltaic effect, which is the basic principle that turns photons from sunlight into electricity when absorbed by the cells on your solar panels.

References

1Carpenter, M., & Feinberg, R. (2022, November 22). Here’s why electric bills are soaring in Maine — and what the state’s trying to do about it. Maine Public. Retrieved August 29, 2023, from <https://www.mainepublic.org/business-and-economy/2022-11-22/heres-why-electric-bills-are-soaring-in-maine-and-what-the-states-trying-to-do-about-it>

2Internal Revenue Service. (2022, December 27). Instructions for Form 5695 (2022). Internal Revenue Service. Retrieved August 29, 2023, from <https://www.irs.gov/instructions/i5695>

3Internal Revenue Service. (2023). Residential Energy Credits. Internal Revenue Service. Retrieved August 29, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

4Internal Revenue Service. (2023, August 28). Residential Clean Energy Credit. Internal Revenue Service. Retrieved August 29, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

5Mack, E., & Dellinger, A. (2023, July 14). Net Metering: How You Can Save Even More With Solar. CNET. Retrieved August 29, 2023, from <https://www.cnet.com/home/energy-and-utilities/net-metering-how-you-can-get-paid-for-solar-power-you-generate/>

6Maine.gov. (2004, March 3). Consumer Rights When Constructing or Repairing Your Home. Maine.gov. Retrieved August 29, 2023, from <https://www.maine.gov/ag/dynld/documents/clg17.pdf>

7Maine.gov. (2023). Energy Efficiency. State of Maine Governor’s Energy Office. Retrieved August 29, 2023, from <https://www.maine.gov/energy/initiatives/energy-efficiency>

8Maine.gov. (2023). Solar. State of Maine Governor’s Energy Office. Retrieved August 29, 2023, from <https://www.maine.gov/energy/initiatives/renewable-energy/solar-distributed-generation>

9Maine.gov. (2023). Electricity Prices. State of Maine Governor’s Energy Office. Retrieved August 29, 2023, from <https://www.maine.gov/energy/electricity-prices>

10Maine.gov. (2023). Residential Electric Rates. Maine Public Utilities Commission. Retrieved August 29, 2023, from <https://www.maine.gov/mpuc/regulated-utilities/electricity/delivery-rates>

11Maine.gov. (2023). State of Maine APPLICATION FOR RENEWABLE ENERGY EQUIPMENT EXEMPTION. Maine.gov. Retrieved August 29, 2023, from <https://www.maine.gov/revenue/sites/maine.gov.revenue/files/inline-files/solar_exempt_app.pdf>

12Neumeister, K., & Smith, M. (2023, August 14). Ecowatch Reviewer Melissa Smith Reviewed by Melissa Smith Updated as of August 14, 2023 Why You Can Trust EcoWatch Why You Can Trust EcoWatch Our content is created and advised by solar industry experts, giving you the information you need to make smart. EcoWatch. Retrieved August 29, 2023, from <https://www.ecowatch.com/solar/panel-cost/me>

13Shah, C. (2014, May 8). Net Metering. U.S. Department of Energy. Retrieved August 29, 2023, from <https://www.energy.gov/sites/prod/files/2014/05/f15/fupwg_may2014_net_metering.pdf>

14Solar Energy Technologies Office. (2022, September 8). Solar Investment Tax Credit: What Changed? Office of Energy Efficiency & Renewable Energy. Retrieved August 29, 2023, from <https://www.energy.gov/eere/solar/articles/solar-investment-tax-credit-what-changed>

15Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Office of Energy Efficiency & Renewable Energy. Retrieved August 29, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

16Solar Reviews. (2023, August 21). Solar panel cost Maine: Prices & data August 2023. SolarReviews. Retrieved August 29, 2023, from <https://www.solarreviews.com/solar-panel-cost/maine>

17U.S. Bureau of Labor Statistics. (2023). Average energy prices for the United States, regions, census divisions, and selected metropolitan areas. U.S. Bureau of Labor Statistics. Retrieved August 29, 2023, from <https://www.bls.gov/regions/midwest/data/averageenergyprices_selectedareas_table.htm>

18U.S. Energy Information Administration. (2023). Electric Power Monthly. U.S. Energy Information Administration. Retrieved August 29, 2023, from <https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_5_6_a>

19Screenshot from State of Maine Website. Maine.gov. Retrieved from <https://www.maine.gov/revenue/sites/maine.gov.revenue/files/inline-files/solar_exempt_app.pdf>

20Screenshot from Maine Public Utilities Commission. Maine.gov. Retrieved from <https://www.maine.gov/mpuc/sites/maine.gov.mpuc/files/inline-files/NEB-Consumer-Initial-Disclosure-finalv0322.docx>